See This Report on Fortitude Financial Group

See This Report on Fortitude Financial Group

Blog Article

The Only Guide for Fortitude Financial Group

Table of ContentsThe Greatest Guide To Fortitude Financial GroupGetting My Fortitude Financial Group To WorkThe 8-Minute Rule for Fortitude Financial GroupNot known Details About Fortitude Financial Group

With the best strategy in place, your cash can go additionally to help the organizations whose missions are aligned with your worths. An economic expert can help you specify your charitable giving goals and incorporate them right into your financial plan. They can also suggest you in ideal means to maximize your offering and tax reductions.If your business is a partnership, you will certainly wish to go via the succession planning procedure with each other - Financial Advisor in St. Petersburg. An economic expert can aid you and your companions understand the essential components in organization sequence planning, determine the value of business, create shareholder contracts, develop a payment structure for followers, overview transition alternatives, and a lot a lot more

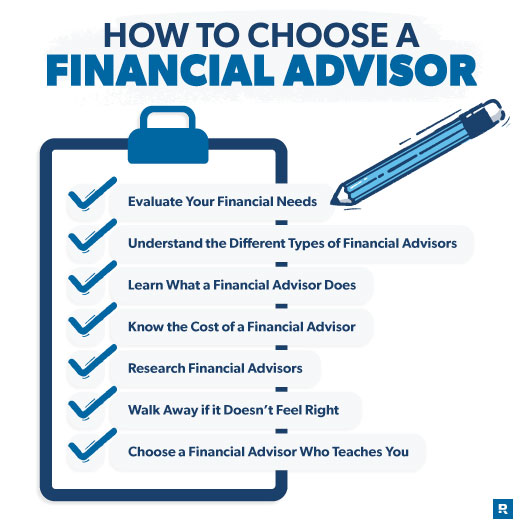

The key is finding the ideal economic advisor for your circumstance; you may wind up interesting different experts at various phases of your life. Attempt calling your monetary organization for referrals. Content is for informational purposes just and is not intended to provide lawful or financial guidance. The views and opinions revealed do not always represent the views and opinions of WesBanco.

Your next action is to consult with a qualified, licensed professional that can supply recommendations customized to your private scenarios. Nothing in this article, neither in any type of linked sources, must be interpreted as monetary or lawful recommendations. While we have made great faith initiatives to ensure that the details offered was right as of the date the material was prepared, we are unable to ensure that it stays accurate today.

Things about Fortitude Financial Group

Financial consultants aid you make choices concerning what to do with your cash. Let's take a better look at what exactly an economic expert does.

Advisors use their expertise and experience to create personalized economic plans that intend to attain the financial goals of clients (https://packersmovers.activeboard.com/t67151553/how-to-connect-canon-mg3620-printer-to-computer/?ts=1724660284&direction=prev&page=last#lastPostAnchor). These plans consist of not only financial investments but also cost savings, spending plan, insurance, and tax obligation strategies. Advisors further examine in with their customers regularly to re-evaluate their existing situation and plan accordingly

The Facts About Fortitude Financial Group Revealed

Let's state you wish to retire in two decades or send your child to a personal university in 10 years. To achieve your goals, you might need a competent specialist with the appropriate licenses to assist make these plans a fact; this is where a monetary consultant is available in (Financial Resources in St. Petersburg). Together, you and your expert will certainly cover several topics, consisting of the amount of money you need to save, the kinds of accounts you require, the sort of insurance you ought to have (consisting of long-lasting care, term life, impairment, and so on), and estate and tax obligation preparation.

Financial advisors provide a selection of solutions to clients, whether that's providing reliable general financial investment guidance or aiding within an economic objective like spending in an university education fund. Below, locate a listing of the most typical solutions supplied by financial advisors.: A financial consultant provides suggestions on investments that fit your style, objectives, and risk resistance, developing and adapting spending technique as needed.: A financial advisor creates strategies to assist you pay your debt and prevent debt in the future.: A monetary expert gives suggestions and strategies to develop budget plans that assist you meet your objectives in the brief and the lengthy term.: Part of a budgeting approach might consist of approaches that help you pay for greater education.: Also, a financial advisor develops a saving plan crafted to your certain requirements as you head right into retirement. https://penzu.com/p/955661562c60f973.: An economic consultant aids you identify individuals or organizations you intend to obtain your tradition after you die and produces a strategy to execute your wishes.: An economic consultant provides you with the most effective navigate to this site long-term solutions and insurance policy alternatives that fit your budget.: When it comes to taxes, a financial advisor might assist you prepare tax returns, make best use of tax deductions so you get the most out of the system, timetable tax-loss collecting protection sales, ensure the very best usage of the capital gains tax obligation rates, or strategy to reduce taxes in retirement

On the survey, you will likewise indicate future pensions and income sources, job retirement needs, and explain any type of lasting economic obligations. Simply put, you'll provide all existing and anticipated investments, pensions, gifts, and income sources. The investing element of the survey touches upon more subjective topics, such as your risk tolerance and risk capacity.

The Main Principles Of Fortitude Financial Group

At this point, you'll additionally let your expert know your financial investment preferences. The first assessment might also consist of an examination of various other financial administration subjects, such as insurance concerns and your tax obligation circumstance.

Report this page